Deciding between renting and owning equipment? Here’s the quick answer: Renting is ideal for short-term, seasonal, or fluctuating needs, while owning makes sense for frequent, long-term usage. Renting offers lower upfront costs, flexibility, and bundled maintenance, while owning provides full control, customization, and potential tax benefits.

Rent or Buy Heavy Machinery? Find out which is best for your business

Key Points:

-

Renting Advantages:

- Lower upfront costs (e.g., $7,500/month vs. $300,000 purchase for a motor grader).

- Maintenance, insurance, and inspections often included.

- Flexibility for seasonal or emergency needs.

- No storage or long-term commitment.

-

Owning Advantages:

- Better for frequent use (over 60-70% of the time).

- Tax benefits like depreciation and equity building.

- Full control and customization of equipment.

- Potential resale value.

Quick Comparison:

| Factor | Renting | Owning |

|---|---|---|

| Upfront Cost | Lower ($7,500/month) | Higher ($300,000 purchase) |

| Maintenance | Included | Owner’s responsibility |

| Insurance | Often included | Additional cost |

| Flexibility | High (short-term needs) | Low (long-term commitment) |

| Tax Benefits | Rental fees deductible | Depreciation, interest deductions |

| Best For | Seasonal/short-term use | Frequent/long-term use |

Bottom Line: Renting suits businesses with changing demands, while owning is better for consistent, long-term use. Understand your needs, costs, and goals before deciding.

sbb-itb-c79a83b

Cost Analysis: Renting vs. Owning

When deciding between renting or owning equipment, it’s important to weigh both upfront costs and long-term financial impacts.

Renting: Smaller Initial Expense

Renting eliminates the need for a hefty upfront payment, like a $100,000 purchase. Instead, costs are spread out into manageable monthly payments, such as $5,000. This allows businesses to keep more capital available for other needs.

Rentals often roll multiple costs into a single monthly fee, which typically includes:

- Maintenance and repairs

- Insurance

- Routine inspections

Using rental management software can make it easier to track expenses and schedule maintenance, adding convenience to the rental process.

As Randy from Blount Contracting explains, renting can lower maintenance costs compared to owning:

"Whether you rent or buy, the cost to fuel and run the equipment will be the same. However, your maintenance costs should be much lower if you’re renting." [5]

Owning: Better for Long-Term Use

Owning equipment makes more financial sense for businesses that use it frequently – over 60-70% of the time [6]. While the upfront costs are higher, ownership offers benefits like:

- Tax and Asset Advantages: Depreciation, loan interest deductions, and potential resale value can help offset the total cost [2].

Cost Comparison Table: Renting vs. Owning

| Cost Factor | Renting | Owning |

|---|---|---|

| Initial Investment | $7,500/month (e.g., motor grader) | $300,000 purchase price [5] |

| Short-Term Monthly Cost (8 months) | $7,500 flat rate | $9,750 financing |

| Long-Term Monthly Cost (12 months) | $7,500 flat rate | $6,500 financing [5] |

| Maintenance | Included in rental fee | Owner’s responsibility |

| Insurance | Often included | Additional cost |

| Tax Benefits | Rental fees are deductible | Depreciation and interest deductions [2] |

Financing costs are estimates and may vary depending on interest rates and terms.

For businesses that only need equipment seasonally – less than six months a year – renting is often the smarter financial choice [6]. While cost is a major factor, don’t overlook how flexibility and control might influence the decision between renting and owning.

Flexibility and Control: Renting vs. Owning

Renting: Agility for Changing Needs

Renting equipment offers businesses the ability to adapt quickly to changing demands. This approach is especially useful in situations like:

- Seasonal or Emergency Needs: Renting ensures you have the necessary equipment during busy periods or unexpected situations, reducing downtime and storage hassles.

- Trial Runs: Renting allows you to test machinery before committing to a purchase, helping you determine if it suits your requirements.

Modern rental platforms make it easier to schedule and track equipment, streamlining the rental process and boosting efficiency.

While renting provides agility, owning equipment offers consistent access and the ability to tailor it to your specific needs.

Owning: Control and Customization

Ownership brings distinct advantages for businesses that need constant access to equipment or require tailored functionality. Here’s why owning might be the better choice:

- Full Control Over Usage: With ownership, you don’t have to worry about availability or scheduling conflicts. This is particularly important for businesses with steady production schedules or strict quality standards [3].

- Tailored to Your Needs: Owning equipment ensures it’s always available and can be customized for specific tasks, which is especially beneficial in specialized industries [3].

Here’s a cost-related example highlighting the benefits of renting:

"Renting this equipment can cost between $252.00 and $408.45 for an 8-hour period, depending on the rental company" [4].

This flexibility in cost makes renting ideal for short-term projects. However, for businesses that use equipment more than 70% of the time, purchasing often proves more economical, while renting suits those with fluctuating needs [6].

Whether you prioritize the adaptability of renting or the control of owning, using rental management tools can help maximize the benefits of either approach.

Using Rental Management Software

Rental management software simplifies equipment rental operations with tools that improve workflows and help businesses make better decisions.

Key Features of Rental Management Software

These platforms come with a variety of tools, including:

- Digital Calendars: Keep track of schedules and equipment availability in real time.

- Automated Inventory Management: Monitor equipment locations and track maintenance needs.

- Digital Contract Management: Handle signatures and renewals automatically.

- Payment Processing: Enable secure online payments.

- Smart Device Integration: Incorporate smart locks and RFID technology for added convenience.

FieldEquip is a great example, offering real-time updates on deliveries, rental durations, and maintenance schedules [1].

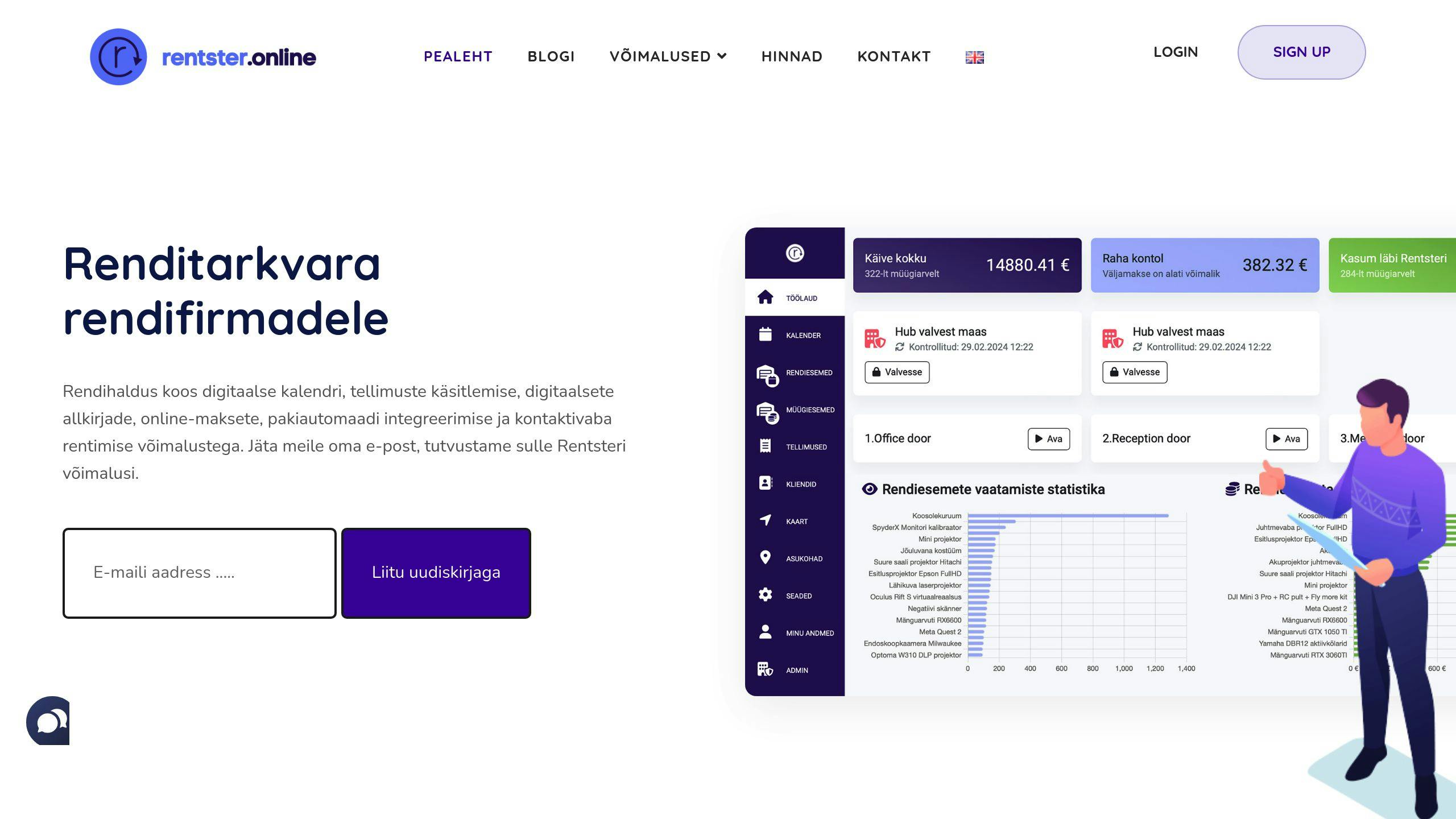

Rentster: A Rental Management Solution

Rentster is designed specifically for equipment rental businesses, offering features like:

- Operations that scale to support multiple locations and users.

- Smart lock technology for around-the-clock equipment access.

- API connectivity to integrate with other systems.

- Support for both short-term and long-term rental arrangements.

Conclusion: Choosing Between Renting and Owning

Deciding whether to rent or own equipment boils down to understanding your business’s specific needs and priorities. Each option has its perks, depending on how often you use the equipment, your ability to handle maintenance, and your long-term goals.

Key Considerations

| Factor | Renting Perks | Owning Perks |

|---|---|---|

| Financial Impact | Lower upfront investment, maintenance included | Builds equity, potential tax perks |

| Flexibility | Great for seasonal demand, access to updated gear | Always available, can be customized |

Tools like Rentster can simplify the rental process, offering features like smart locks and automated payment systems. These solutions help businesses save time, manage resources better, and stay competitive.

To make the right choice, consider these steps:

- Look at the full cost of ownership, including maintenance, depreciation, and storage.

- Review your project timelines and how frequently you’ll need the equipment.

- Think about how quickly technology in your industry changes.

- Assess whether you have the resources to maintain and store equipment.

The rental industry is changing fast, thanks to technology. Businesses that use data to guide their decisions will be better equipped to stay efficient and grow in this evolving market.